- Early planning is essential

Address risks and opportunities across governance, operations, and people. - Holistic readiness drives value

Balance financial performance with culture, systems, and ESG strategy. - Independent assessment matters

Identify gaps and create a tailored roadmap for exit success. - Tax and compliance are critical

Proactive management prevents delays and protects shareholder value. - Grant Thornton UAE is your trusted partner

We deliver bespoke readiness assessments and hands-on support throughout the process.

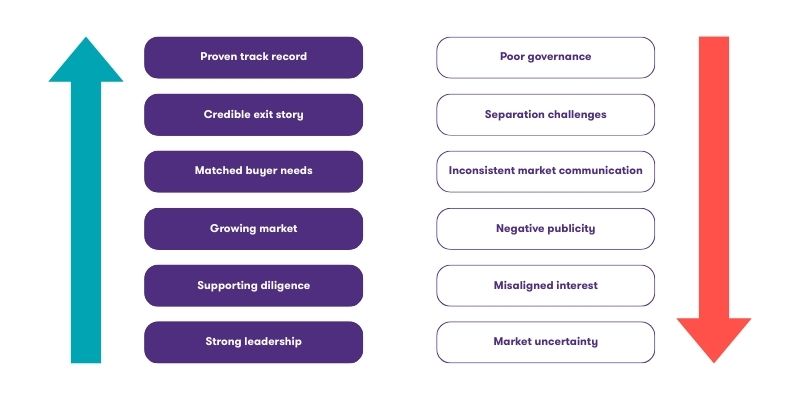

Value leakage factors

When preparing for a transaction, there are levers to pull that can enhance value, as well as areas to address to ensure that value is protected. Value leakage can, and does, occur at various stages throughout the exit cycle. It can be difficult for businesses to prepare fully for exit processes, and it is often too late once an exit gains momentum. Planning early with sufficient breadth and detail is critical for maximising value on exit.

Grant Thornton UAE empowers businesses to maximise value and achieve successful exits through tailored, actionable advice and hands-on partnership. This guide shows what you need to do, and shares our approach for helping you do it.

Are you confident your business is ready to achieve maximum value at exit?

Forecasts and planning: The fundamentals of protecting value

Drawing on our extensive experience supporting clients through exit processes, we’ve identified six key areas that we believe are fundamental to success:

- Early preparation and identifying key risks and opportunities across the full breadth of your business – not just your historical financial performance but your enabling-infrastructure, governance, and people.

-

Flexible planning for alternative exit strategies, reflecting likely bidder requirements.

-

Clarity on historical performance drivers and robust historical financial information.

-

A well-articulated business plan, underpinned by realistic assumptions and robust plans, which bidders can easily understand and ‘buy-in’ to, and can be translated into a strong forecast model supported by a robust forecasting process.

-

Strong and consistent leadership of the exit process and an appropriate focus on change management.

-

Tax is often the largest cost in a transaction and, if not managed proactively, can erode shareholder value, delay execution, or even cause deals to fall through.

Value leakage can be mitigated by proper preparation. We highly recommend that your first step is an independent exit readiness assessment to identify aspects of your business which will need to be addressed or leveraged for a successful and smooth exit process. Our readiness assessment is a modular toolkit that helps you fully understand your gaps in successful exit preparation.

Taking a holistic view

While financials are central to any transaction, focusing solely on them can risk future performance and sustainability. Likewise, culture alone won’t guarantee operational readiness. True optimisation comes from balancing the ‘what’ (strategy, plans, and numbers), with the ‘how’ (values, systems, and behaviours) that shape decision making and refine the sales story. This holistic view helps minimise value leakage and strengthens exit outcomes.

Key exit readiness considerations

Independent readiness assessment

All organisations are different, so we don’t take a cookie cutter approach. Where you have already formed your own view in any area, we’ll scope out sections accordingly to create your bespoke exit readiness assessment.

- Does the current leadership team have the capabilities and experience to manage the company during the transition and beyond?

- How will preparation and the transaction itself be planned, managed, and resourced?

- Is there a clear succession plan for key roles?

- Are you clear on who needs to be ‘in the circle’ and who will remain outside?

- Do you have a clear plan for what to communicate, when, and to which audiences?

- What plans are in place to incentivise and retain key people?

- Will the exit planning affect the culture of your organisation, and how will you manage that with potential buyers?

- Is the corporate story clear, supported by a robust business plan that will stand up to bidder scrutiny?

- Is the deal thesis or strategy clear, including the likely bidder types and specific potential interested parties?

- Is the deal perimeter clear and defined (i.e. brands, business units, divisions, territories, assets, contracts, shares)?

- Are you planning for an appropriate exit mechanism and route?

- Does the exit strategy align with the company’s long-term goals and objectives?

- Have you conducted a business valuation and assessed the company’s market position to understand potential valuations?

- Are the key value drivers identified and clearly articulated in the business plan to attract potential buyers?

- Does the current business plan showcase growth potential effectively to attract potential buyers?

- Have you analysed your competitive position in your market, and can you communicate your differentiated proposition clearly?

- Do you have clarity on the underlying drivers of the historical performance?

- How robust is your operational performance, capability, and cost base?

- What are your plans for improvement, including rationale, benefits, and opex/capex?

- Is your working capital performance optimised? If not, when and how should you improve it, considering your intended exit timing?

- Do you have an appropriate ESG strategy in place, with processes to enable accurate reporting?

- Have the social impacts of the exit been evaluated?

- Are you up to date with your ESG reporting – including sustainability, gender pay gap, payment practices and other similar requirements?

- Is your ESG story compelling, authentic, and demonstrable enough to drive exit value?

- Is your governance structure conducive to your desired exit?

- Will an exit require any regulatory approvals (e.g. SCA for IPOs, anti-market competition approval for selected sales)? Are you prepared for these (i.e. do you have the right documentation), and how will they impact your timeline?

- Is the infrastructure for your governance suitable for your intended buyer?

- Are there any aspects of governance compliance which require remediation?

- Are you ‘diligence ready’ in terms of financial information and other data?

- Do you have robust and comparable historical and forecast financial information, including quality of earnings, cash flows and net assets?

- How flexible are your forecasts and forecasting process, including sensitivity analysis?

- Are your forecasts providing realistic projections, based on historical data and market trends?

- Is your data formatted for dashboards that allow quick visual analysis and interrogation by buyers or their diligence providers?

- Does your equity structure deliver value to shareholders and key management in a tax-efficient way?

- Have you clearly defined the transaction perimeter, including which assets, entities, or activities should be retained or excluded, to ensure alignment with buyer expectations and maximise deal value?

- Do you have tax assets that could generate savings pre- or post-transaction, which could be leveraged to negotiate additional value?

- Are you prepared for buyside tax due diligence? If this is a secondary buyout, have any previous diligence findings been addressed?

- How effectively will your cyber security environment and business continuity plans protect the business?

- What red flags might IT due diligence highlight?

- Do you have a clear systems development roadmap that extends out beyond your intended exit date?

- How future-fit is your technology landscape?

- Do you have sufficient documentation to support due diligence into your teams?

- Do you have a documented risk management strategy and management framework?

- Have you carried out a thorough risk assessment?

- Do you have an internal audit function? Who does it report to?

- Do you have an internal audit plan, and how do you monitor timely resolution of findings?

- If the business has historically relied on a shared finance service within a larger group or function, how will the finance function be structured post-exit?

- If the exit is in the form of an IPO, can the finance team meet the strict reporting deadlines set by SCA?

- Can you simplify and standardise processes to eliminate unnecessary complexity and inconsistencies?

- Do you have the right people in the right roles in order to achieve a successful exit – building the business ahead of exit, preparing for the transaction, managing the transaction itself, and adding value thereafter?

- Do you have the capacity and experience in-house to project manage your roadmap to exit?

- Will any enabling functions be seen as critical for business plan delivery post-deal?

- Are your Finance, IT, and HR functions capable of preparing for a transaction while simultaneously managing ‘business as usual’?

- Are these teams ready to respond quickly to requests during the exit process?

- Could the buyer inherit potential liabilities from ongoing legal cases?

- Have you considered conducting legal due diligence?

- Can you demonstrate full compliance with all laws and regulations?

- Is your legal team aware of all the regulations that are relevant to the exit?

Our approach to exit readiness

We provide the rounded view of readiness you need across these twelve aspects – leveraging our extensive exit experience, including dual track processes. We’ll deliver your exit-readiness assessment, identify and close remediating gaps, and project manage your transaction.

At Grant Thornton UAE, we’re your trusted partner throughout the process.

Ready to maximise your exit value?

Contact Kabir Dhawan, Neha Julka, Komil Ahmetov, Nishanth Krishnan, Marwan Galal, or Alex Tsui for tailored insights and support.