What is e-invoicing?

E-invoicing is a digital solution for issuing, transmitting, and receiving invoices between suppliers and buyers in a structured electronic format. Mandated by the UAE Ministry of Finance (MoF), e-invoices are generated and processed in XML format, ensuring seamless data exchange between accounting systems. It is important to note that unstructured invoice formats such as pdf, word document, images, scanned copies and emails are not e-invoices.

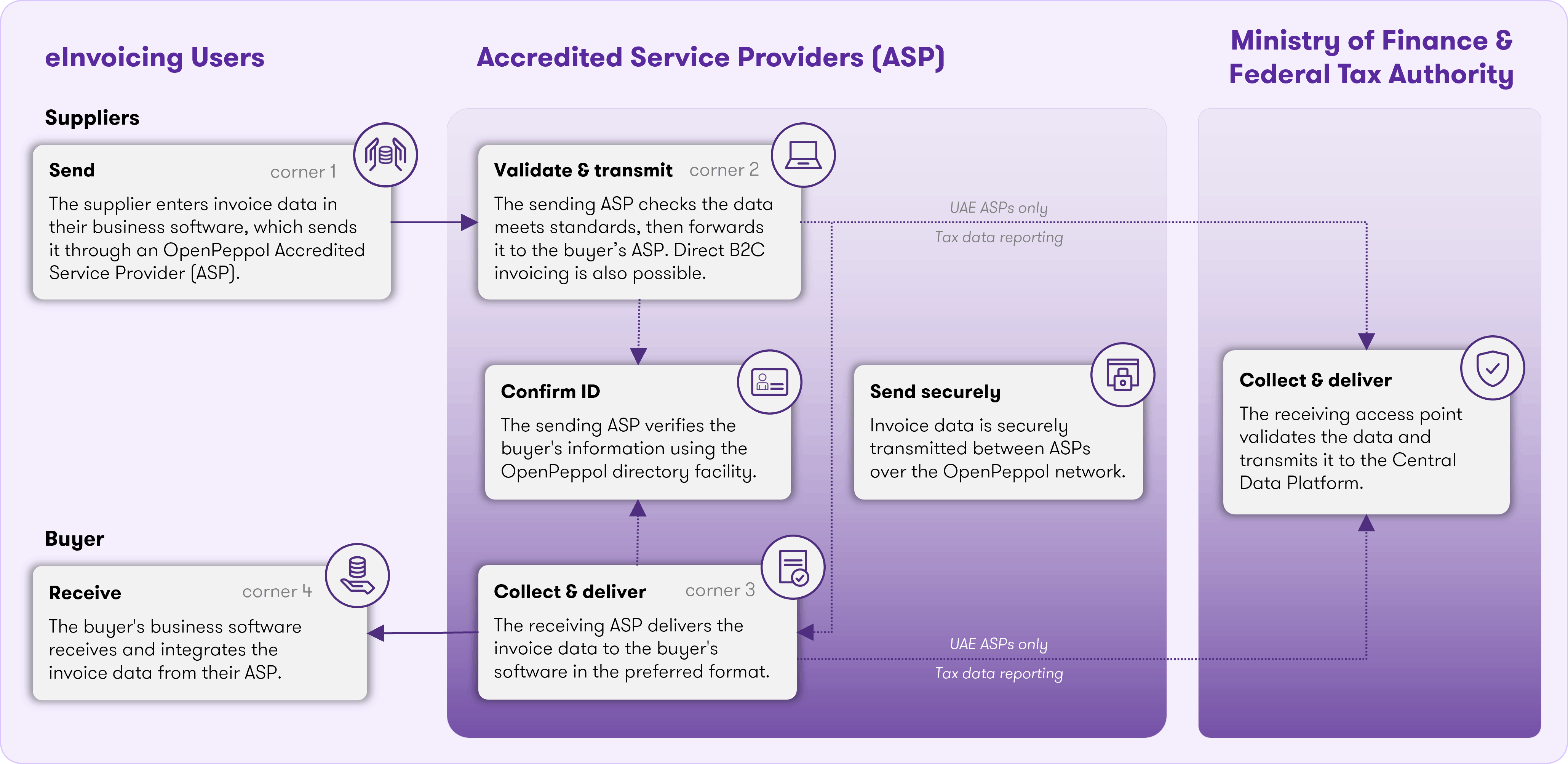

The UAE’s e-invoicing system will be implemented around the PEPPOL “5-corner” decentralised model, where the Federal Tax Authority (FTA) is positioned in the fifth corner to oversee, collect, and store e-invoices. Under this framework, businesses are required to engage with an Accredited Service Provider (ASP), a technology vendor officially recognised and accredited by the UAE MoF. These ASPs act as intermediaries, facilitating the transmission of e-invoices between buyers and sellers while ensuring compliance with technical and legal standards.

Why e-invoicing?

E-invoicing in the UAE is introduced to create a more digitally enabled fiscal ecosystem by reducing human intervention in business and tax reporting processes.

E-invoicing will not only streamline operations but also optimises efficiency by lowering costs, reducing processing times, and minimising paper wastage, thereby supporting sustainability goals. By fostering a community of skilled digital experts, e-invoicing contributes to the development of a robust digital economy.

Additionally, e-invoicing plays a crucial role in several areas:

Identifies and addresses both unintentional and deliberate efforts of VAT leakages.

Leverages big data insights to enhance economic growth and competitiveness.

Bolsters security through encrypted transactions and secure data exchanges, reducing the risk of fraud and unauthorised access.

Provides near real-time data to the UAE government, aiding policy makers in identifying areas that require support and intervention, thus contributing to informed decision-making.

Upcoming mandate

Starting July 2026, the UAE will commence Phase 1 of its national e-invoicing rollout through a pilot programme involving selected businesses. This phase will focus on business-to-business (B2B) and business-to-government (B2G) transactions, with mandatory adoption beginning 1 January 2027 for entities with annual revenues of AED 50 million or more. Subsequent phases will extend the mandate to businesses having annual revenue of less than AED 50 million and government entities.

While business-to-consumer (B2C) transactions are currently excluded, future expansion is anticipated.

Exceptions

Sovereign government entities

Government entities performing activities in a sovereign capacity.

International passenger transport

International passenger transport services (with electronic ticket) and ancillary airline services directly to passengers (with electronic miscellaneous document).

Air freight transport (temporary exemption)

International transport of goods by air, documented by an airway bill (for the first 24 months from the date on which the electronic invoicing system becomes effective).

VAT-exempt or zero-rated financial services

Financial services that are VAT-exempt or zero-rated.

Business-to-consumer (B2C) transactions

B2C transactions, currently outside the mandatory scope.

How does E-Invoicing work?

- Supplier (Corner 1) submits e-invoice data to Accredited Service Provider (ASP) (Corner 2).

- Corner 2 validates and converts e-invoice to XML format, then transmits it to buyer's ASP (Corner 3).

- Corner 2 reports Tax Data Document (TDD) to Central Data Platform managed by FTA (Corner 5).

- Corner 3 validates e-invoice and sends Message Level Status (MLS) to Corner 2.

- Corner 3 submits e-invoice to Buyer (Corner 4) and reports TDD to Corner 5.

- Corner 5 sends MLS to Corner 2 and Corner 3 upon successful TDD reporting.

- Corner 2 forwards MLS from Corner 3 and Corner 5 to Supplier (Corner 1).

- Corner 3 forwards MLS from Corner 5 to Buyer (Corner 4).

How Grant Thornton can help

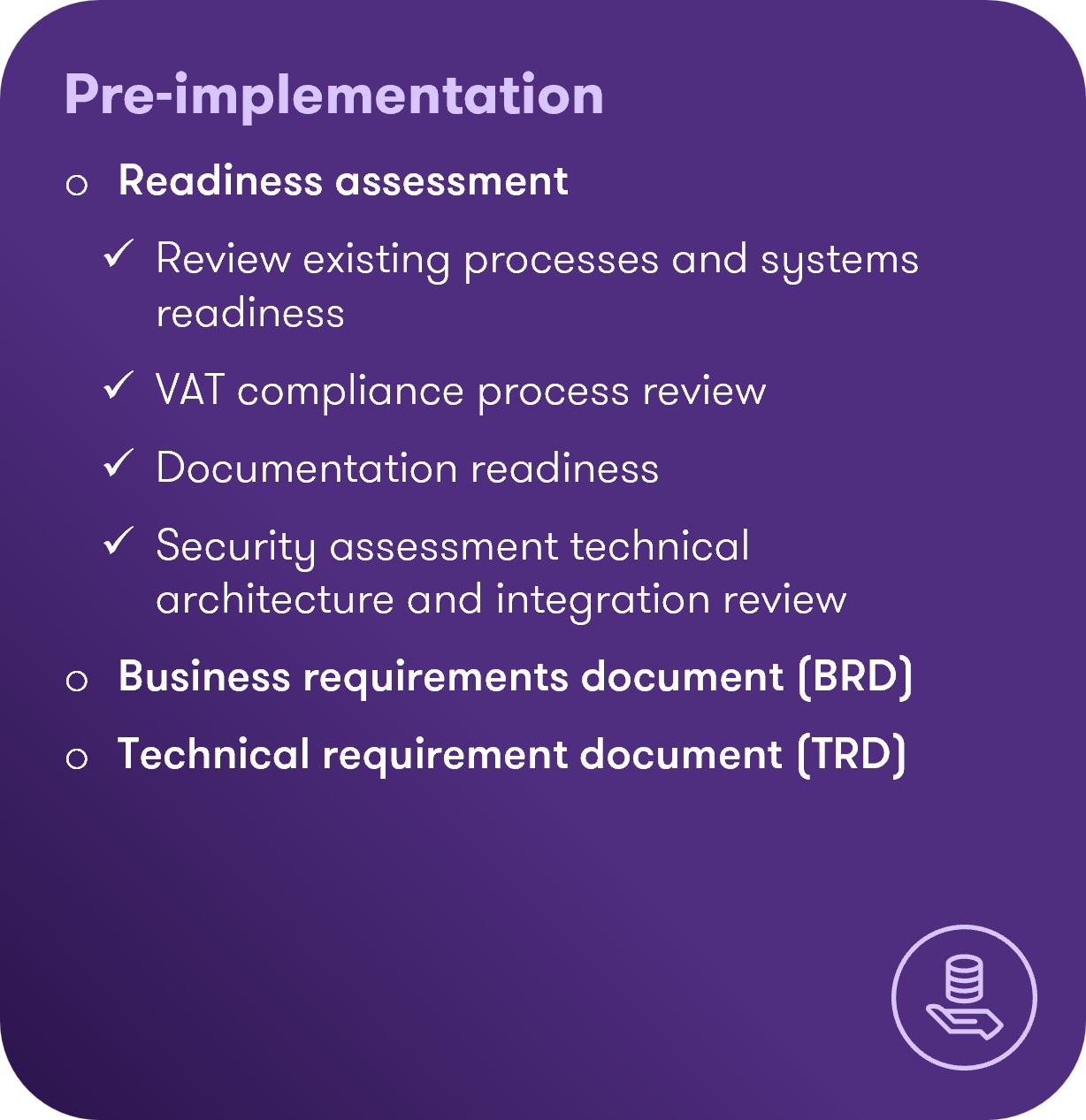

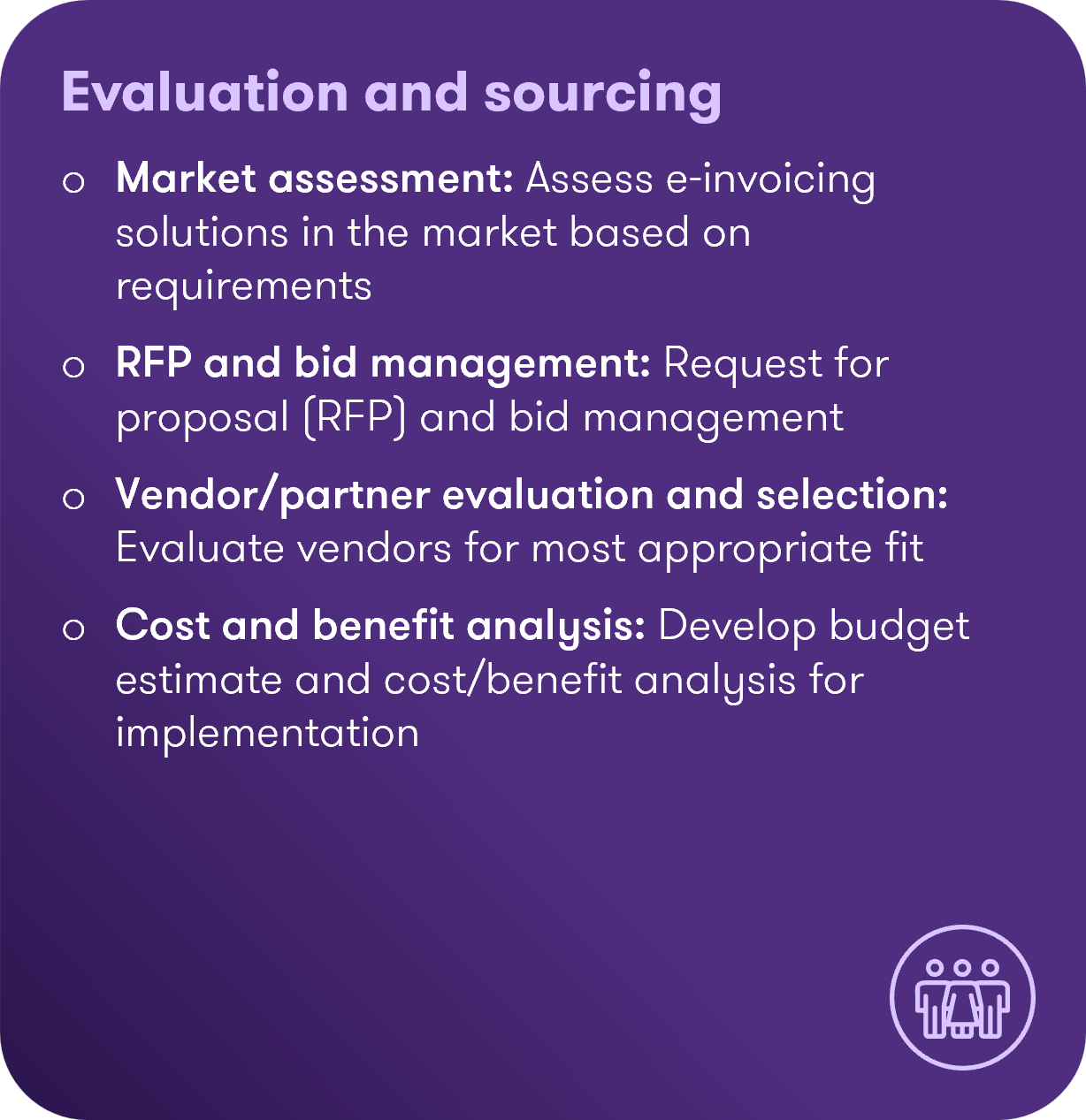

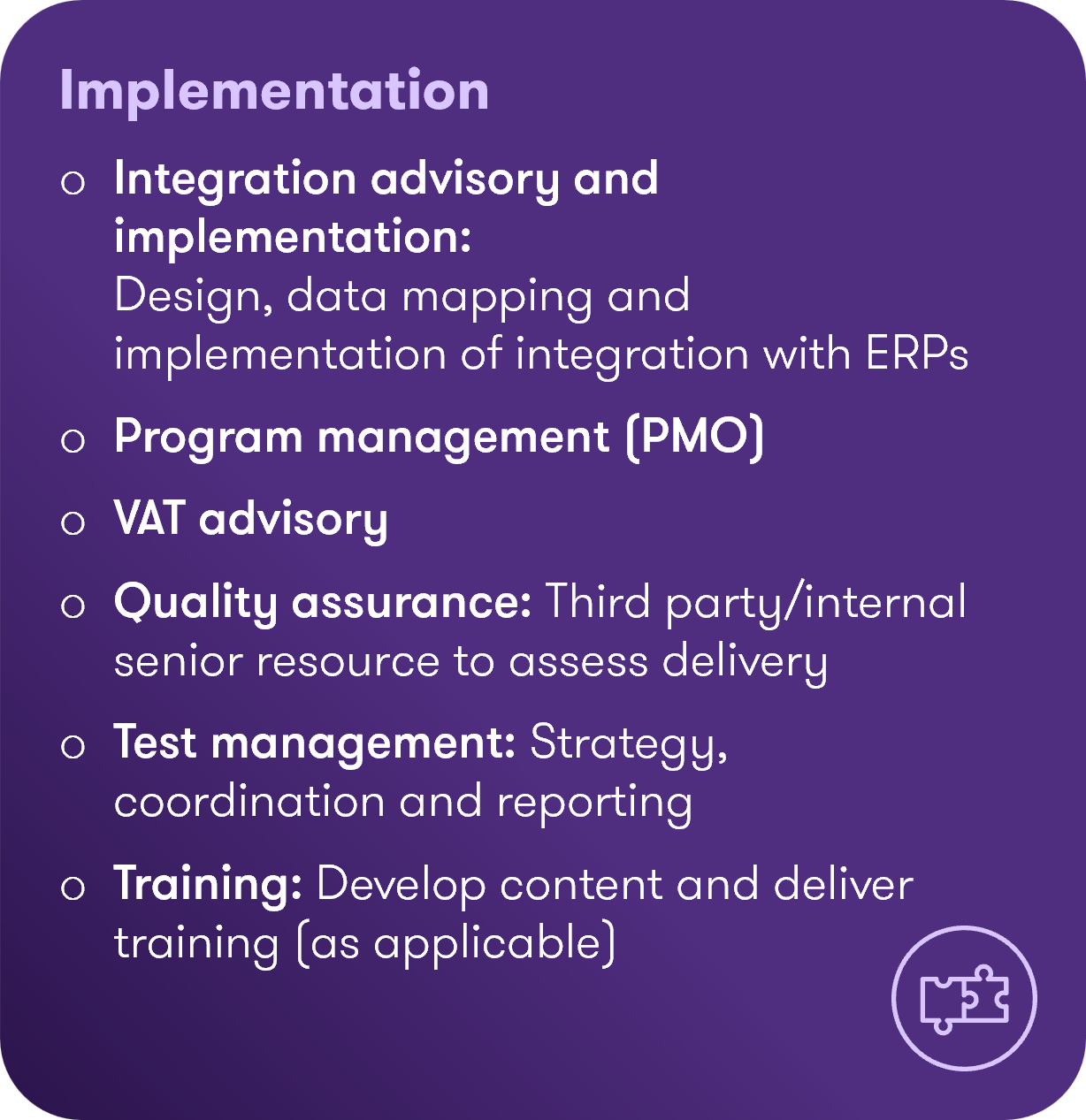

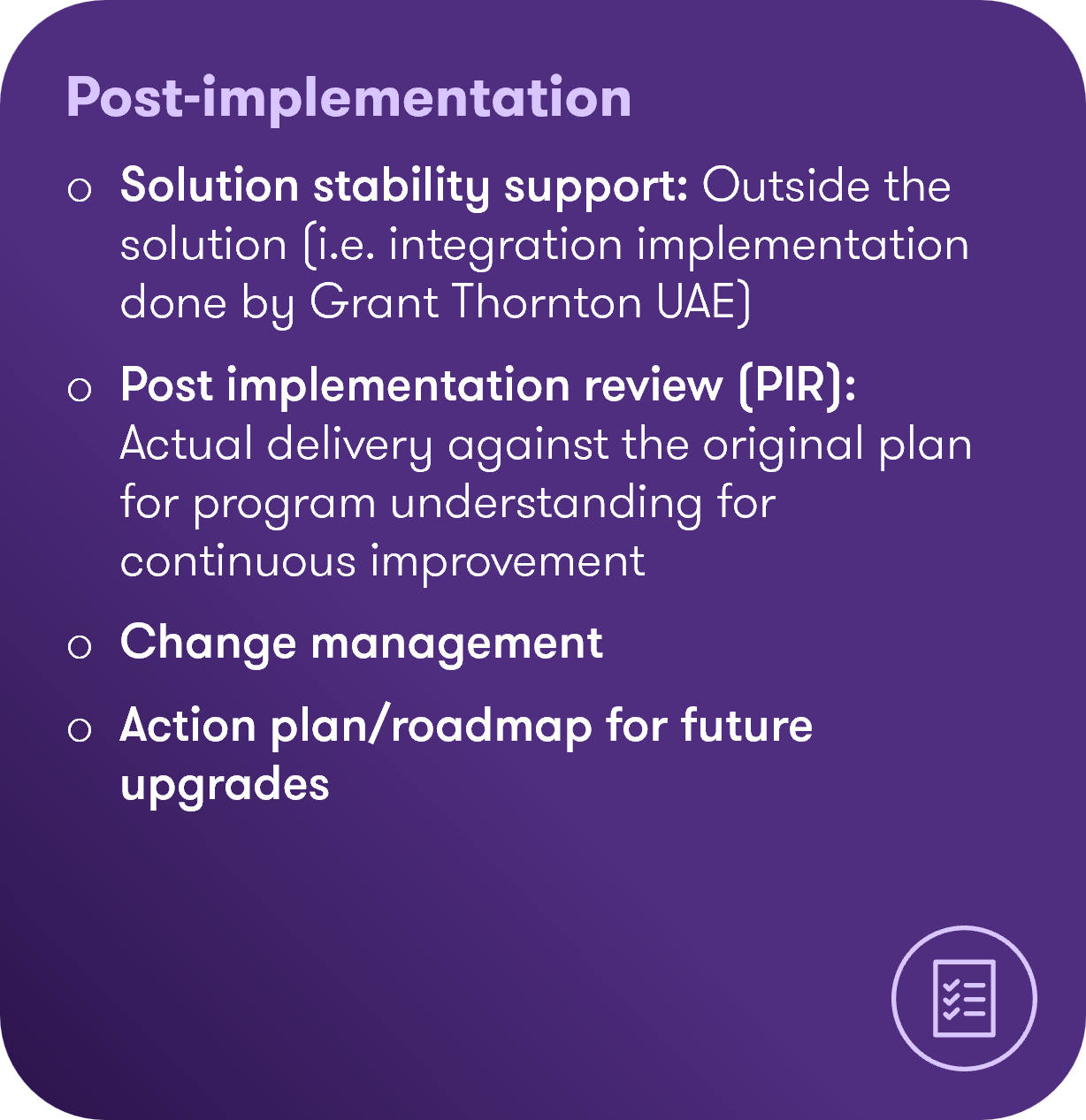

To align with the UAE's e-invoicing regulations, businesses must upgrade their ERP systems to facilitate seamless integration with the e-invoicing infrastructure. At Grant Thornton, we offer comprehensive services to support your transition to the UAE's e-invoicing system, ensuring regulatory compliance and enhancing operational efficiency. By proactively addressing these changes, businesses can achieve a smooth transition while adhering to tax regulations and optimising their processes.

Our team of experts specialises in evaluating your systems, implementing tailored solutions, and providing comprehensive training to ensure your team is fully equipped to navigate the latest regulations. Reach out to the GT E-Invoicing team to explore how we can support your e-invoicing requirements and facilitate a seamless digital transition for your business. Let us guide you through this crucial transition with our strategic insights and hands-on expertise.