Rethinking compliance: A strategic lens

As the UAE moves closer to its July 2026 e-invoicing mandate, many businesses are understandably focused on meeting regulatory requirements. However, as explored in our recent webinar co-hosted with Avalara—a global leader in tax technology—this transition presents far more than a compliance challenge. It’s a timely opportunity to modernise finance operations, enhance data quality, and build resilience into your tax and reporting functions.

At Grant Thornton UAE, our approach to e-invoicing is shaped by what businesses need most:

- Practical guidance to navigate readiness assessments, ERP integration, and ASP selection.

- Local expertise to help businesses understand and adapt to the UAE’s decentralised model, especially in contrast to neighbouring jurisdictions like Saudi Arabia.

- A strategic lens that positions e-invoicing as a lever for finance transformation, not just a compliance requirement.

Why e-invoicing is more than compliance

E-invoicing gives tax authorities near real-time access to transactional data, enabling them to use machine learning and pattern recognition to detect anomalies. As Chris Park, Strategy Director at Avalara, explained:

“Tax authorities are using real-time data and machine learning to detect anomalies instantly, changing the way audits are triggered and conducted.”

This shift means businesses must move away from reactive compliance and instead focus on proactive data integrity. Clean, structured invoice data is no longer optional — it’s foundational.

Misconceptions across borders: UAE vs. KSA

Many multinationals operating in both the UAE and Saudi Arabia assume their systems can be replicated across jurisdictions. But as Harsh Bhatia, VAT Director at Grant Thornton UAE, clarified:

“While similar in intent, the UAE is adopting a decentralised model using accredited service providers, unlike Saudi’s centralised approach. The technical and operational differences matter.”

To help businesses navigate regional differences, here’s a side-by-side comparison of the UAE and KSA models.

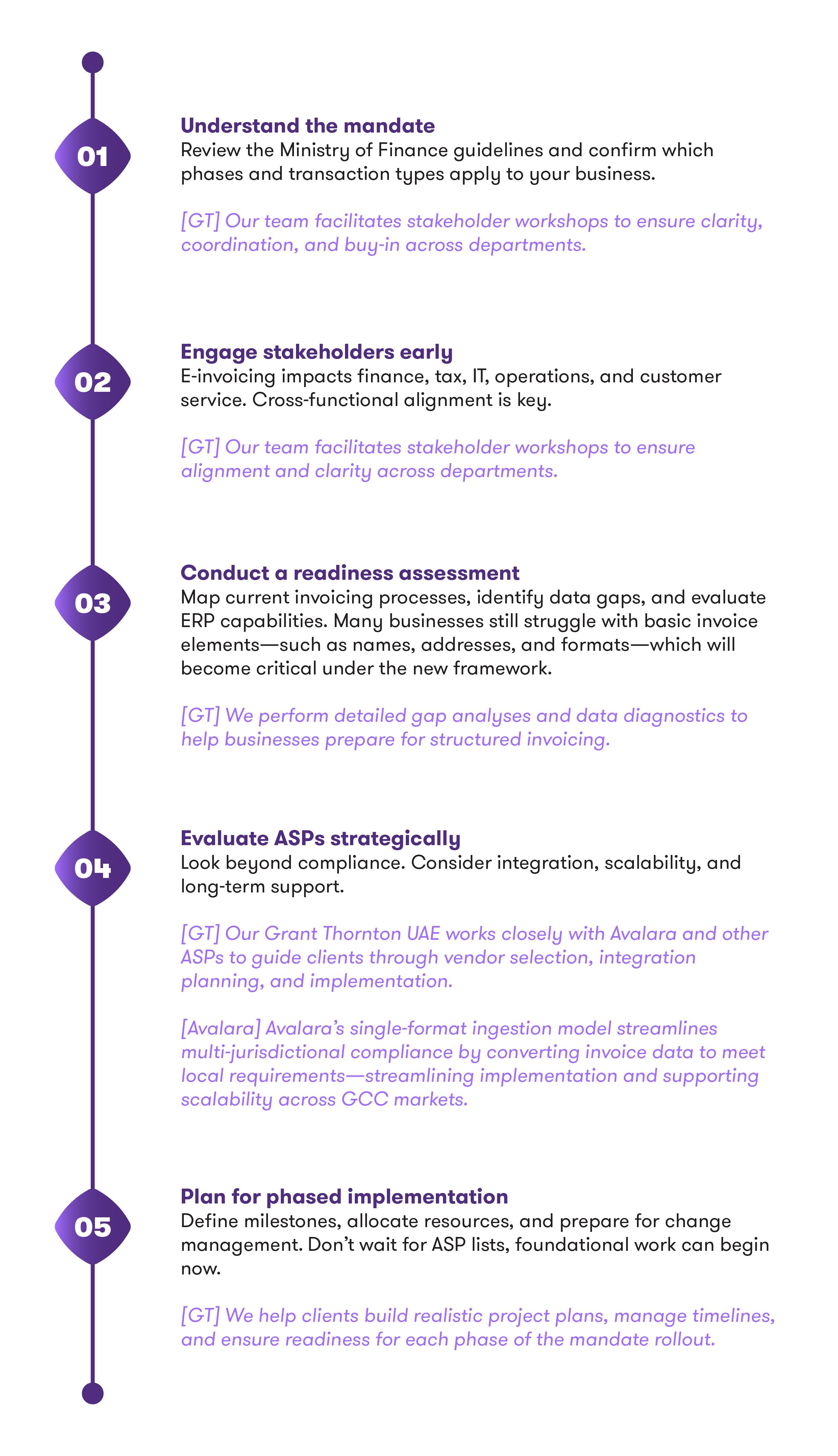

From insight to action: A practical roadmap

At Grant Thornton UAE, we support businesses at every step of the journey, offering a clear path from awareness to implementation. Here's how we do it:

Sector-specific strategies

Different industries face unique challenges in adapting to e-invoicing. The webinar highlighted tailored approaches:

A catalyst for finance modernisation

As one of our experts summarised:

The UAE’s mandate is clear. But the opportunity is yours to define — whether you choose to meet the minimum requirements or leverage this moment to modernise.

Key takeaways

- E-invoicing is not just a tax requirement; it’s a strategic enabler.

- The UAE’s decentralised model differs significantly from Saudi Arabia’s centralised approach.

- Early readiness assessments and stakeholder engagement are essential.

- Industry-specific challenges require tailored solutions.

- Grant Thornton UAE works closely with Avalara to deliver end-to-end e-invoicing solutions—from readiness assessments to ASP integration.

We're here to help

Whether you're just starting your e-invoicing journey or refining your implementation strategy, our professionals are here to help your business stay compliant and competitive.

Grant Thornton UAE e-invoicing services

If you would like to learn about what e-invoicing services we provide, you can visit our page here.

Avalara e-invoicing

For more details on Avalara's e-invoicing initiatives and services, you can visit their website here.

This article draws on themes discussed during a previous webinar hosted by Grant Thornton UAE. We thank the hosts for their valuable contributions and insights.