-

Statutory Audit

We conduct an integrated audit, which combines the financial statement audit,independent and objective assurance on financial information, transactionsand processes.

-

Limited Review

We offer services relating to reviews of historical financial informationby expressing negative assurance on such historical financial information.

-

Agreed Upon Procedures

We engage with organisationsto perform specific procedures and report findings to conform to their needs.

-

Financial Reporting Advisory Services (FRAS)

Our team provides timely advice on the impact of accounting changes to assist businesses in the development of an appropriate implementation roadmap.

-

Business Consulting

Grant Thornton UAE provides organisations with implementable plans that drive sustainable growth strategies to grow and optimise their business performance.

-

Business Risk Services

Organisations need to understand risks thoroughly to be able to manage them better. Grant Thornton UAE helps businesses achieve the best balance between minimising risk exposure, optimising profitability and developing compliance review checklists.

-

Regulatory Advisory Services

Grant Thornton UAE's extensive understanding of the overarching supervisory framework within the region equips our professionals to support financial institutions comply and abide by the set of regulatory mandates throughout the rapidly evolving ecosystem.

-

Financial Advisory

Grant Thornton UAE works with organisations on transactions from start to finish, assisting with strategy, identifying risks, executing deals, and helping to unlock their potential for growth and value creation.

-

Restructuring Advisory

Grant Thornton UAE is committed to realising value for shareholders, in a way that recognises and supports the interests of all stakeholders. Our solutions maximise value, provide clarity and direction, and accelerate recovery and transformation for businesses.

-

Technology Advisory & Cybersecurity

IT and technology are fundamental to drive the performance of businesses. Through leveraging the power of technology, Grant Thornton UAE helps organisations define and identify growth opportunities to achieve value-driven transformation and innovation.

-

Forensics

Fraud and corruption pose a growing challenge worldwide. As the commercial landscape changes, an increasingly regulated environment requires stringent governance and compliance processes. Grant Thornton UAE helps organisations navigate challenges and crisis with a hands-on approach coupled with the use of technology.

-

ESG Services

The Environment, Social and Governance (ESG) agenda has gained significant traction over the years, to become one of the key strategic aspects of any business. It is imperative that all organisations, irrespective of industry sector, engage with their stakeholders and prioritise ESG practices to unlock sustainable growth opportunities.

-

Business Process Solutions

Our team at Grant Thornton offers comprehensive and cost effective outsourced solutions, enabling stakeholders and business owners to focus on their core business goals.

-

Corporate Tax

Our diversified team of corporate tax subject matter experts combines a perfect blend of international experience across several industry sectors, technical expertise, and commercial nuances with a commitment to deliver exceptional value to your business.

-

VAT

The VAT team at Grant Thornton is well versed with the VAT Laws applicable across the region and holds valuable experience and professional accreditation in assisting clients across diverse industries to comply with the VAT obligations.

-

Transfer Pricing

Grant Thornton UAE assists its clients in providing transfer pricing solutions that are implementable and operational, considering the facts and concerns of its clients.

-

International Tax and Tax Due Diligence

Grant Thornton UAE supports multinational groups to optimise their tax structures. We can also assist businesses in analysing existing group transactions and inter-group supplies, as well as advising on potential implications of various taxes to facilitate an efficient Group tax structure.

-

Economic Substance Requirements

Economic Substance rules were introduced in the UAE in 2019, requiring UAE businesses that undertake certain ‘Relevant Activities’ to maintain and demonstrate adequate substance.

-

Customs and International Trade

The team at Grant Thornton is positioned centrally to assist the businesses with global cross-border tax structuring, planning and compliance needs.

-

Excise Tax

We provide Excise Tax related advisory and compliance services to the producer, importer, and the storekeeper of excisable goods

Global survey finds majority of businesses automating processes, with some lower skill manufacturing jobs likely to disappear

Fifty years on from the world’s first personal computer going into mass production, the Grant Thornton International Business Report, a survey of 2,571 executives in 36 economies, reveals the scale of technology’s influence on business with the majority of firms now planning to automate operations and practices. The findings suggest that some jobs will go as a result, with the manufacturing, cleantech and food & beverage sectors in particular reporting upheaval. With capital costs low as labour costs rise, the findings pose fundamental questions about the extent to which machines will eventually replace humans.

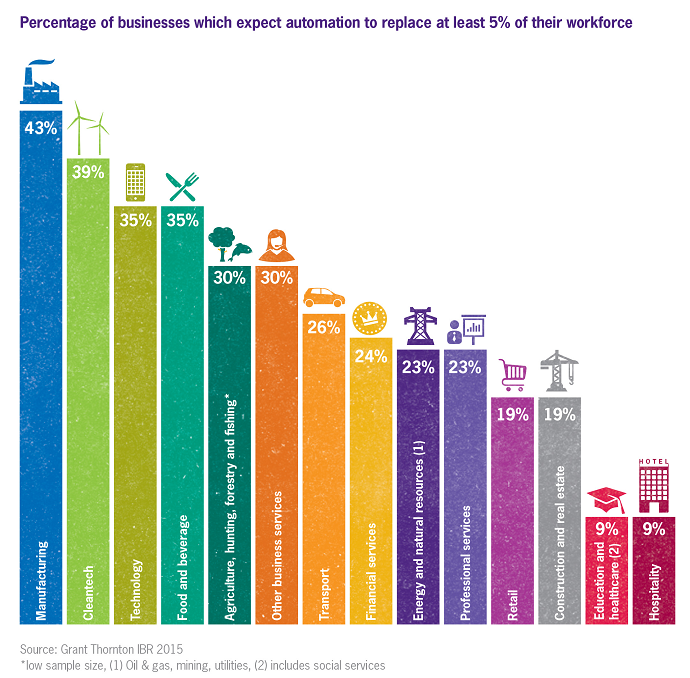

Globally, over half (56%) of firms surveyed told Grant Thornton they are either already automating business practices or may do over the next 12 months. By industry, 43% of manufacturing firms said they expect this to eventually replace at least 5% of their workforce. Cleantech was in second place on 39%, followed by the technology and food & beverage sectors on 35%. At the other end of the spectrum, just 9% of hospitality, education and healthcare firms expect 5% or more of workers to be replaced.

Steven Perkins, global leader for technology at Grant Thornton, said: “In this digital age, businesses are looking to technology at an ever increasing pace. Post-financial crisis, firms continue to strive for greater efficiency and better productivity. But fifty years on from PCs going into mass production, costs of capital are low while labour costs increase. As businesses consider whether to invest in staff or machines, for many, the latter is becoming the more cost-effective option.”

Further research conducted by Grant Thornton uncovered increasing business spend on research and development – underpinning the growth in automation. In 2011 23% of businesses globally said they were planning to boost R&D spend; that increased to 26% in 2014 and so far in 2015 it stands at a five-year high of 29%.

Steve Perkins added: “Are robots set to replace the workforce? That may be premature; technology has been introduced to the workplace since the industrial revolution and job roles have adapted accordingly. In fact, it’s likely the wrong question. We should be asking: ‘What human capabilities will be most enhanced?’ Clearly, the rise of artificial intelligence (AI), supercomputers and sensors - previously the preserve of science fiction - will have profound consequences for jobs, pay and the make-up of workforces. We may continue to see people redeployed to lower-paid service roles as high-powered and previously high-paid jobs become the preserve of intelligent machines. Without intervention we will continue to see a growing divide in income and opportunity between knowledge-based and service-based economies and careers.

“This poses significant societal challenges. Technology is part of our lives in ways we couldn’t have imagined two decades ago, from the rise of big data to the app revolution. That trend will continue and it means the shape and size of workforces of the future will look radically different to those of today. How businesses and governments deal with these changes will be critical to long term economic growth prospects.

“While some job losses will occur as technological advances increasingly transform both the private and the public sector, technology will complement and enhance human capabilities, increasing both the quality and quantity of our efforts.”

Grant Thornton’s findings also suggest that opportunities will arise for workers to assume new roles and responsibilities created by an increased use of technology. Globally over half of automating firms (54%) expect to redeploy workers in other areas, with 28% saying that workers will be trained to operate new machinery. Even in manufacturing, 44% of firms plan to redeploy rather than remove staff.

Steve Perkins commented: “The roles reserved for humans could look very different years from now and some will feel the effects more sharply. Automation in the first industrial revolution made us stronger, made us faster in the second, and in the third will give tremendously greater insights. The possibilities are enormous.

“History has proven that workforces are resilient and adaptable but the rise of intelligent machines, analytics and an ubiquitous 'internet of things' pose significant opportunities and challenges. No sector or profession is immune. Increased dialogue between governments, businesses and education institutions will help us better understand where gaps in the labour market will exist, to ensure we have a pipeline of people being educated and trained to fill those roles.”