Transaction momentum building

Companies are increasingly focused on high-quality strategic transactions, with less time spent on investigating peripheral opportunities, according to our annual tracker of business leader M&A intentions. Despites some familiar challenges and uncertainties, underlying growth is relatively strong in many developed economies, while other key metrics such as interest rates, employment and availability of funding are also positive. The historically cyclical transaction market may well be at a point where the objectives and valuations of buyers are broadly aligned according to our research.

A growing appetite for acquisitions

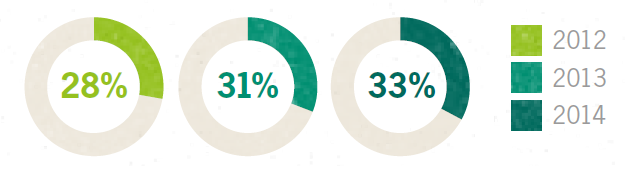

In an improving M&A market (33% of business leaders globally plan to grow through acquisition over the next three years - see chart below), acquirers are becoming more selective about which opportunities they spend their time on. And with market activity increasing, the prospects for strategic M&A activity over the next three years are also on the rise.

Vendor confidence returns

The supply of available targets is key for a successful M&A market. Since the financial crisis potential vendors confidence in achieving a successful exit has been low, driven by modest financial performance, valuation concerns and perceived transaction risks, such as availability of buyer funding.

A changing funding landscape

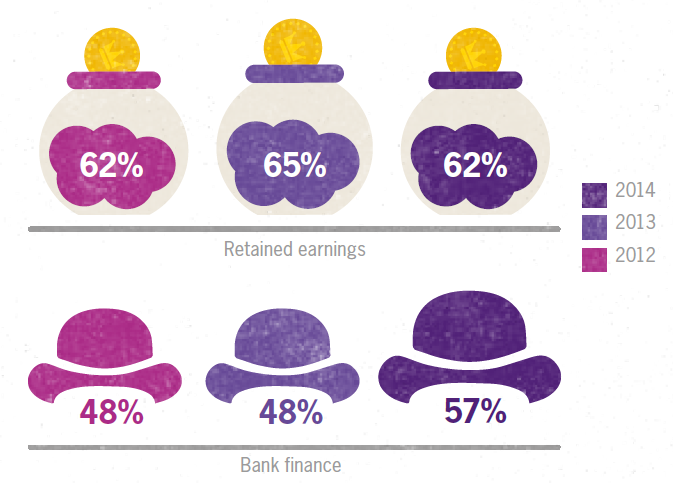

A key element in an active M&A market is confidence in the ability to fund transactions. Whilst retained earnings remain a significant source of funding, our 2015 report indicates a major breakthrough in the confidence to secure bank funding. This reflects the increasing liquidity in the debt market, particularly as the alternative lending sector continues to grow. 57% of respondents expect to finance deals through debt compared to only 48% in each of the last two years (see chart below).