In December 2025, the UAE Federal Tax Authority (“FTA”) released its Corporate Tax Guide on Advance Pricing Agreements (“APAs”), formally introducing an APA programme under the UAE Corporate Tax regime. This is a significant milestone in the development of the UAE’s transfer pricing framework and reinforces the country’s commitment to alignment with OECD best practices. The programme provides taxpayers with a voluntary, structured mechanism to obtain upfront certainty on the arm’s length pricing of controlled transactions, thereby reducing transfer pricing risk, minimising disputes, and enhancing predictability over future corporate tax outcomes. Implementation is phased, initially through Unilateral APAs (“UAPAs”), with Bilateral and Multilateral APAs (BAPA/MAPA) expected to follow in later phases. UAPAs will apply prospectively at launch and will be binding on the FTA and the taxpayer, subject to the agreed terms.

This alert summarises the key features of the APA programme, outlines the procedural and commercial elements relevant for taxpayers, and highlights the practical implications for businesses operating in the UAE.

Background and legislative framework

Transfer pricing provisions were introduced in the UAE with the enactment of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses (the “Corporate Tax Law”). Article 34 of the Corporate Tax Law requires transactions and arrangements between related parties to comply with the arm’s length principle, consistent with OECD standards.

Article 59 of the Corporate Tax Law permits taxpayers to apply for an APA to agree in advance with the FTA on the criteria for determining the arm’s length price of controlled transactions. The APA Corporate Tax Guide issued in December 2025 provides procedural guidance on the scope of the programme, eligibility conditions, application process, monitoring requirements, and the legal effect of APAs.

The APA guide is not legally binding but is intended to assist taxpayers in understanding the FTA’s approach to the APA programme and its practical application under the UAE Corporate Tax regime.

Overview of the UAE APA programme

An APA is an agreement between the FTA and a taxpayer that establishes, in advance, the transfer pricing methodology and pricing criteria to be applied to specified controlled transactions over a fixed period of time. APAs are voluntary and are intended to provide certainty and prevent future disputes rather than resolve existing controversies.

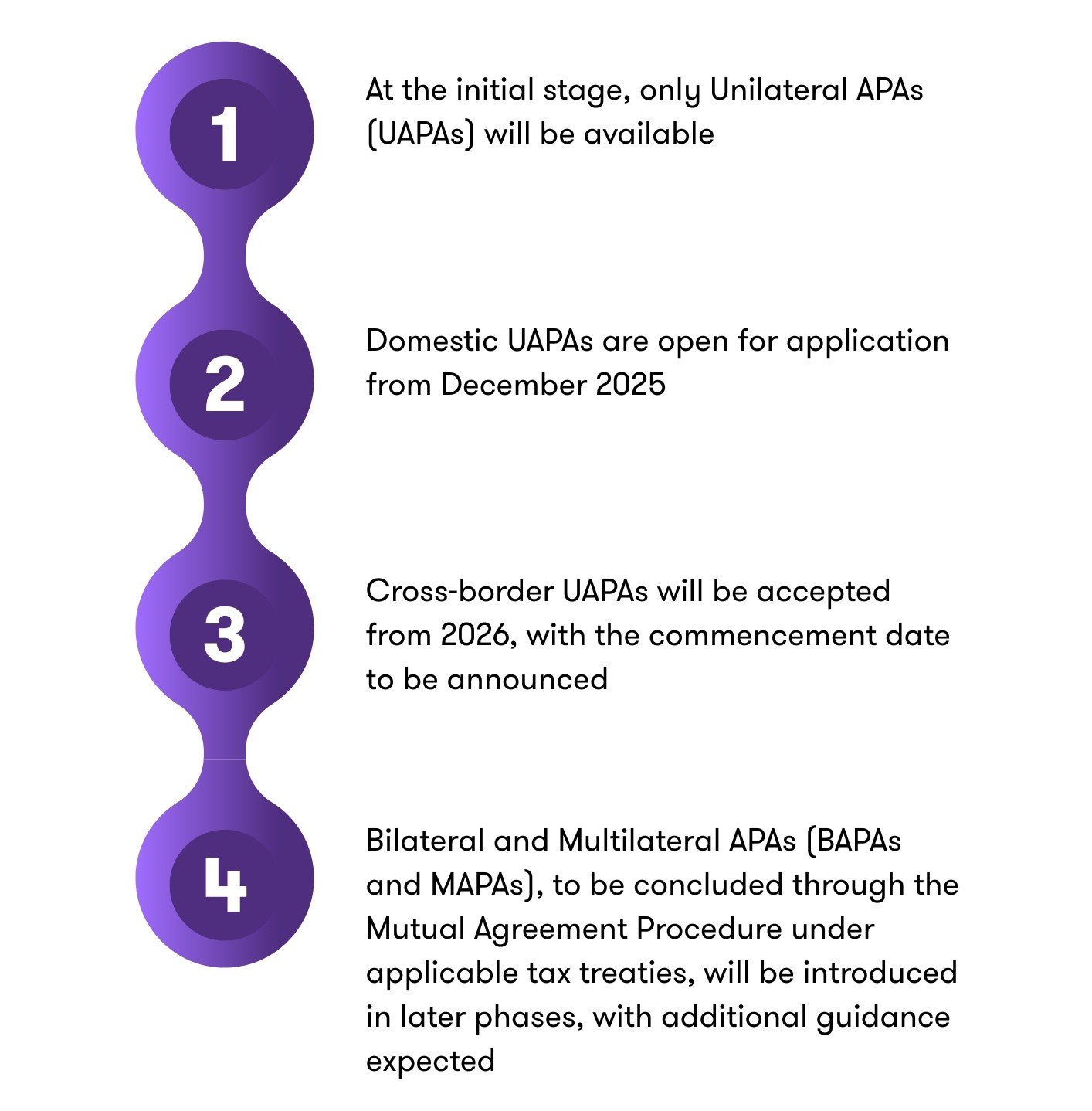

The FTA is introducing the APA programme in a phased manner:

APAs will apply only to prospective periods at this stage and will be binding on both the FTA and the taxpayer, subject to compliance with the agreed terms and conditions. However, UAPAs are not binding on any foreign taxpayer or foreign tax administration that is a counterparty to the controlled transactions covered under the UAPA.

As a result, a taxpayer may face double taxation if the foreign tax administration disagrees with the UAPA concluded with the FTA and makes adjustments to the transfer price. In such cases, the taxpayer will need to rely on other remedies to resolve the double taxation, such as a Bilateral/Multilateral Advance Pricing Agreement (BAPA/MAPA) or the Mutual Agreement Procedure (MAP).

UAPAs for cross-border controlled transactions will be shared with foreign tax authorities in the jurisdictions of the ultimate parent, immediate parent, and transaction counterparties. If a taxpayer obtains an UAPA from a foreign tax authority for the same transactions, they must notify the FTA.

Key elements of the APA programme

Eligibility

Any taxable person that has entered into, or proposes to enter into, domestic or cross-border controlled transactions may apply for an APA, subject to meeting the prescribed criteria. Domestic controlled transactions may be eligible where the parties are subject to different tax rates or benefit from tax incentives under the Corporate Tax Law.

Examples of domestic transactions that may be covered include transactions involving Qualifying Free Zone Persons and mainland entities, government-related businesses, extractive and non-extractive natural resource activities, and situations where different business segments of the same taxpayer are subject to differing tax treatments.

Controlled transactions covered by safe harbour provisions, including low value-adding intra-group services, are excluded from the scope of the APA programme.

Materiality threshold

As a general rule, an APA application may be submitted where the aggregate arm’s length value of the controlled transactions proposed to be covered is at least AED 100 million per tax period. The threshold is determined based on the taxpayer’s own arm’s length analysis at the time of application.

For Tax Groups, the threshold applies at the group level and is assessed by aggregating the value of controlled transactions with related parties outside the Tax Group. Transactions between members of a Tax Group are generally excluded, unless they are required to be recognised for specific Corporate Tax purposes.

While the AED 100 million threshold serves as an indicator of materiality, it is not an absolute requirement. The FTA retains discretion to accept or reject applications based on the specific facts and circumstances, including transaction complexity, tax risk, and the overall benefit of entering into an APA.

Scope and period of an APA

An APA sets out the agreed criteria for determining the arm’s length price of covered controlled transactions. This may include the selection of the most appropriate transfer pricing method, benchmarking parameters, pricing mechanisms, and agreed adjustments.

An APA must cover a minimum of three and a maximum of five tax periods. At the initial stage of implementation, UAPAs will apply only to future tax periods and will not have retroactive effect.

APA fees

An APA application is subject to a non-refundable fee of AED 30,000, payable at the time of filing the formal application. This fee covers the APA process, including any revisions or amendments to the application.

A reduced non-refundable fee of AED 15,000 applies for the renewal of an existing APA, provided there are no material changes in the underlying facts, circumstances, or critical assumptions.

APA application process and timelines

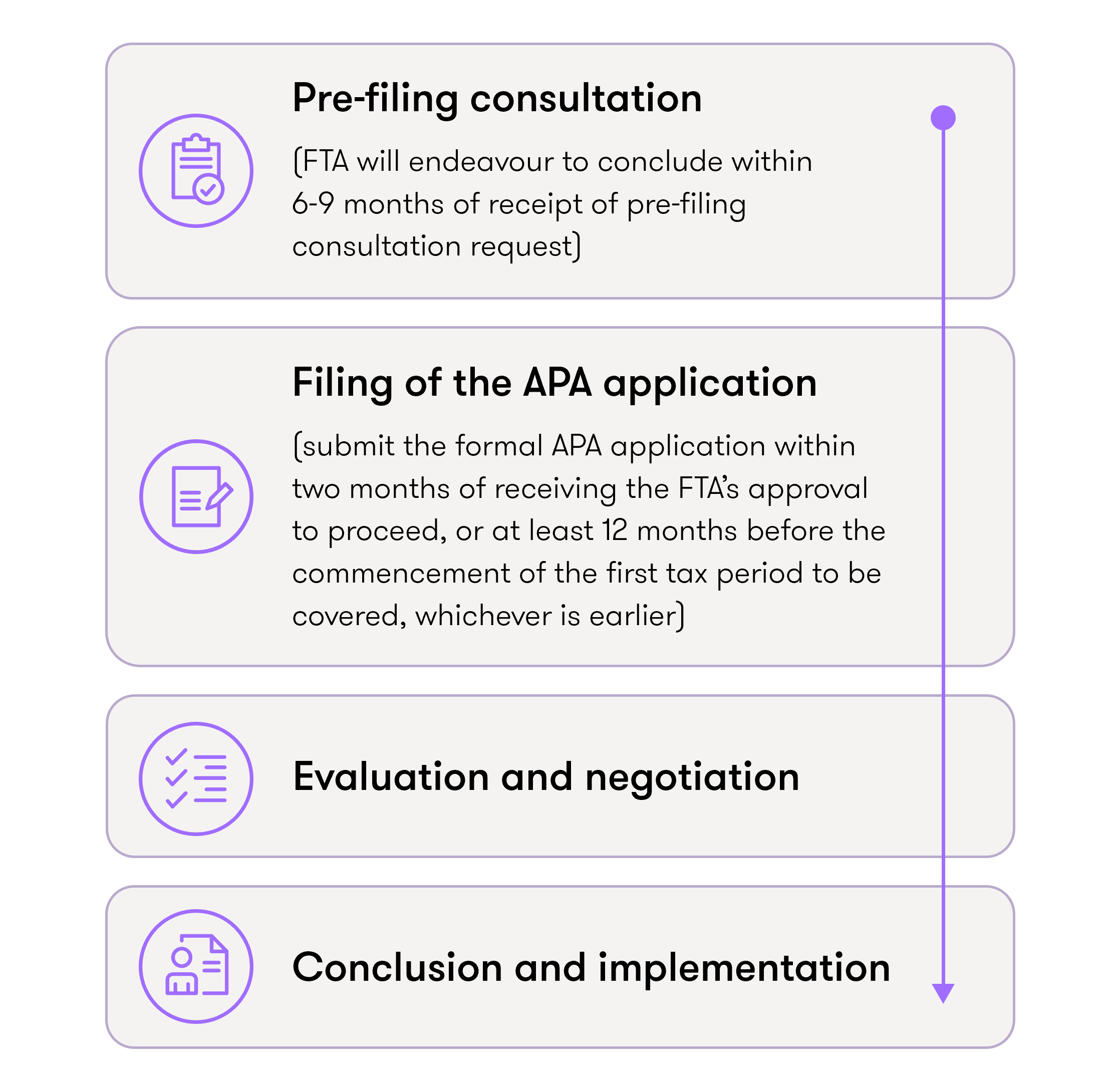

The APA process consists of four distinct stages:

A pre-filing consultation is mandatory and is intended to assess the suitability of the proposed APA, clarify the scope of transactions, and identify potential transfer pricing issues. This stage does not bind the FTA to conclude an APA and does not provide certainty on the taxpayer’s transfer pricing position.

Following a successful pre-filing consultation, the taxpayer must submit the formal APA application within two months of receiving the FTA’s approval to proceed, or at least 12 months before the commencement of the first tax period to be covered, whichever is earlier.

The FTA has indicated that the pre-filing consultation stage may take approximately six to nine months, depending on the complexity of the transactions and the quality and timeliness of information provided. Subsequent stages will be governed by a mutually agreed project plan. Where additional information is requested, taxpayers are generally expected to respond within 40 business days.

Taxpayers should note that filing an APA will not affect any ongoing tax audits relating to years preceding the APA period or to years covered by the UAPA.

Critical assumptions, monitoring, and compliance

APAs are based on a set of “critical assumptions” relating to business operations, economic conditions, legal and regulatory environments, and financial or tax circumstances. These assumptions are fundamental to the validity of the APA.

Taxpayers are required to notify the FTA within 20 business days of any breach or modification of a critical assumption. Depending on the nature and impact of the change, the APA may be revised, cancelled prospectively, or revoked.

Taxpayers that have entered into an APA must file an APA Annual Declaration for each covered tax period, demonstrating compliance with the agreed methodology, pricing criteria, and assumptions. The FTA may review these declarations to verify ongoing adherence to the APA.

Failure to comply with material terms, misrepresentation of facts, or breach of critical assumptions may result in cancellation or revocation of the APA, with potentially significant consequences for prior and future tax periods.

What this means for businesses

The introduction of the APA programme provides an important risk management and certainty tool for businesses operating in the UAE, particularly multinational groups and entities with complex or high-value related-party transactions. APAs allow taxpayers to proactively address transfer pricing risk in the context of the UAE’s relatively new Corporate Tax regime and the increasing focus on transfer pricing compliance and audits.

For businesses with material domestic transactions—especially those involving Free Zone entities, government-related activities, or differing tax profiles—the availability of domestic UAPAs offers a structured mechanism to manage potential pricing disputes within the UAE tax system. For multinational groups, the planned expansion to cross-border UAPAs and, ultimately, BAPAs and MAPAs signals the UAE’s growing engagement in international dispute prevention frameworks.

However, APAs require a significant investment of time and resources. Successful applications depend on robust transfer pricing documentation, reliable financial projections, consistent operational conduct, and strong internal governance processes. Businesses should carefully assess whether their transactions meet the materiality threshold, identify areas of uncertainty, and evaluate whether the benefits of certainty outweigh the costs and compliance obligations associated with an APA.

Early planning, internal alignment across tax, finance, and business functions, and proactive engagement with advisors will be critical for taxpayers seeking to leverage the APA programme effectively as the UAE transfer pricing landscape continues to mature.

How Grant Thornton can assist

Contact our tax team

For more details regarding this Tax alert or other tax issues, reach out to our team of experts listed below on the latest tax developments within the UAE and the Middle East region.