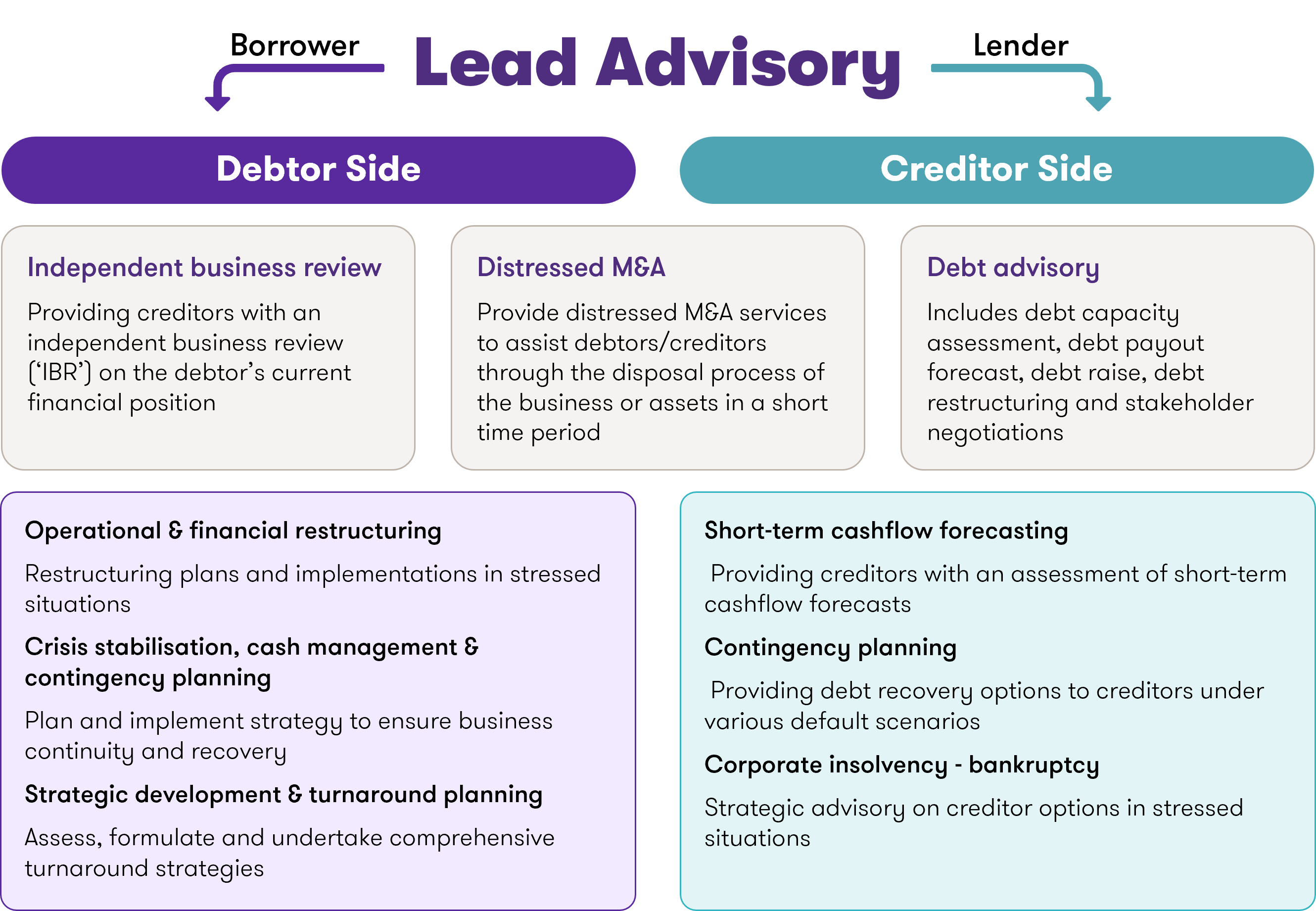

We offer comprehensive restructuring advisory services to both lenders and borrowers. Our specialized team delivers customized solutions to clients experiencing financial distress, guiding them through challenging periods.

What we offer you

Our services include Independent Business Review (IBR) providing parties an overview of the debtor’s financial position, Distressed M&A to assist parties through the disposal of business or its assets in a short time period, Debt Capacity Assessment and stakeholder negotiations, Operational & Financial restructuring, Contingency planning, Turnaround planning, Cashflow Management and Forecasting, etc.

Facing any of these situations? It’s time to reach out.

Recognizing financial strain early & engaging with lenders

Identifying warning signs before they become critical and communicating effectively about financial difficulties.

Resolving disputes & renegotiating supplier terms

Addressing competing interests and securing better payment terms to stabilize operations.

Strategic business realignment & model evaluation

Adjusting to market disruptions while assessing the viability of your current business approach.

Strengthening financial position before new opportunities

Enhancing stability to confidently pursue growth and expansion.

Exploring alternatives to formal insolvency proceedings

Seeking flexible solutions that protect stakeholder value during financial uncertainty.

Navigating complex cross-border restructuring challenges

Accessing expert guidance for international financial transitions